Solar costs have fallen dramatically over the years. The same is true for many complementary technologies like batteries. The change has been so significant that many common solar policy debates are out of date. Several high leverage, non-subsidy policy levers are available that can unlock more solar deployment while also making deployment more sustainable for the entire energy system. I make the case below for policies relating to utility scale and distributed solar.1

For utility-scale solar:

- Limit Local Authority to Deny Solar

- Restrict local governments’ ability to deny solar projects while eliminating property tax breaks that reduce their revenue. These tax breaks are counterproductive because they reduce local governments’ willingness to approve solar farms.

- Simplify Grid Interconnection with Connect and Manage

- Implement market-based, simplified interconnection processes to reduce fees and uncertainty, enabling faster generator integration and better transmission utilization.

- Adopt New, Cost-Effective Technologies

- Encourage monopoly utilities through state regulatory hearings to adopt newer, cheaper technologies.

- Market-Driven Solar and Batteries will Smooth Production and Consumption

- Allow market forces to develop more affordable solar farm designs and integrate storage batteries to enhance value. Solar’s variability is being tamed by falling battery costs, and policymakers need only to let it happen.

- End Solar Panel Tariffs

- Remove tariffs on solar panel imports. Tariffs on solar panel imports add uncertainty and cost. Policy should focus instead on supply-side industrial policies to boost domestic production if necessary.

For distributed solar:

- Adopt SolarAPP+ to Simplify Permitting

- Promote the adoption of simplified permitting processes, such as SolarAPP+, to reduce costs and expand competition for solar installers.

- Eliminate Utility Approval for Safe Home Systems

- Remove the need for utility approval for home systems with safe designs, bypassing the interconnection process for non-exporting systems.

- Legalize DIY Solar

- Formalize and legalize plug-in and DIY solar systems, following examples set by countries like Germany.

- User-Friendly Investment Tax Credit

- Convert the investment tax credit into a lump sum payment claimable by installers so that savings pass directly to customers.

- Refine Net Energy Metering

- Adjust net energy metering rates to accurately reflect the market value (or lack thereof) of electricity exported to the grid.

Utility-Scale Solar

Big solar farms have the classic advantages of scale. Utility scale solar is 30 to 80 percent cheaper than distributed solar, and the returns to scale flatten once the project size exceeds 20 megawatts.2

The immediate challenges facing utility-scale projects are accessing grid connections and gaining local approvals.

A later challenge is market saturation. Solar installations have similar production profiles, creating a midday glut. A solar panel’s daily production looks like a bell curve. Solar farms can produce enough electricity to meet all demand near noon (and drive prices to zero), but still only meet 25 to 30 percent of daily electricity demand.

New technology can help solve these problems several ways:

- Cheaper batteries can flatten the daily production profile, making better, more cost-effective use of grid connections.

- New solar farm configurations can cut land use in half, easing local permitting.

- Batteries and more compact facilities increase tax payments per acre, providing greater value to local governments.

Solar farms with predictable outputs that add value locally help alleviate concerns about grid saturation, reliability, and local permitting. However, new technologies are less helpful for interconnection and transmission; these issues require policy change.

Future Utility-Scale Solar Technology

Solar technology has advanced dramatically over the past few decades, with solar panel costs falling more than 99 percent. The panels are now a small portion of total cost, and the market is pushing improvements that further reduce the cost and increase the value of farm-produced solar electricity. Primary efforts are focused on increasing panel efficiency, reducing the non-panel costs of solar farms, and adding battery storage.

Solar panel efficiency has increased from roughly 15 percent to more than 20 percent in the last decade. New designs like Tunnel Oxide Passivated Contact (TOPCon) cells will take efficiency close to 25 percent, up from about 21 percent for the best modules today.3 Tandem cells that use multiple layers have the potential to reach 30 percent efficiency in the next 5 to 10 years while maintaining a competitive price. Efficiency is important because it increases the output per panel. The same solar farm design produces more electricity, making its labor and materials more productive.

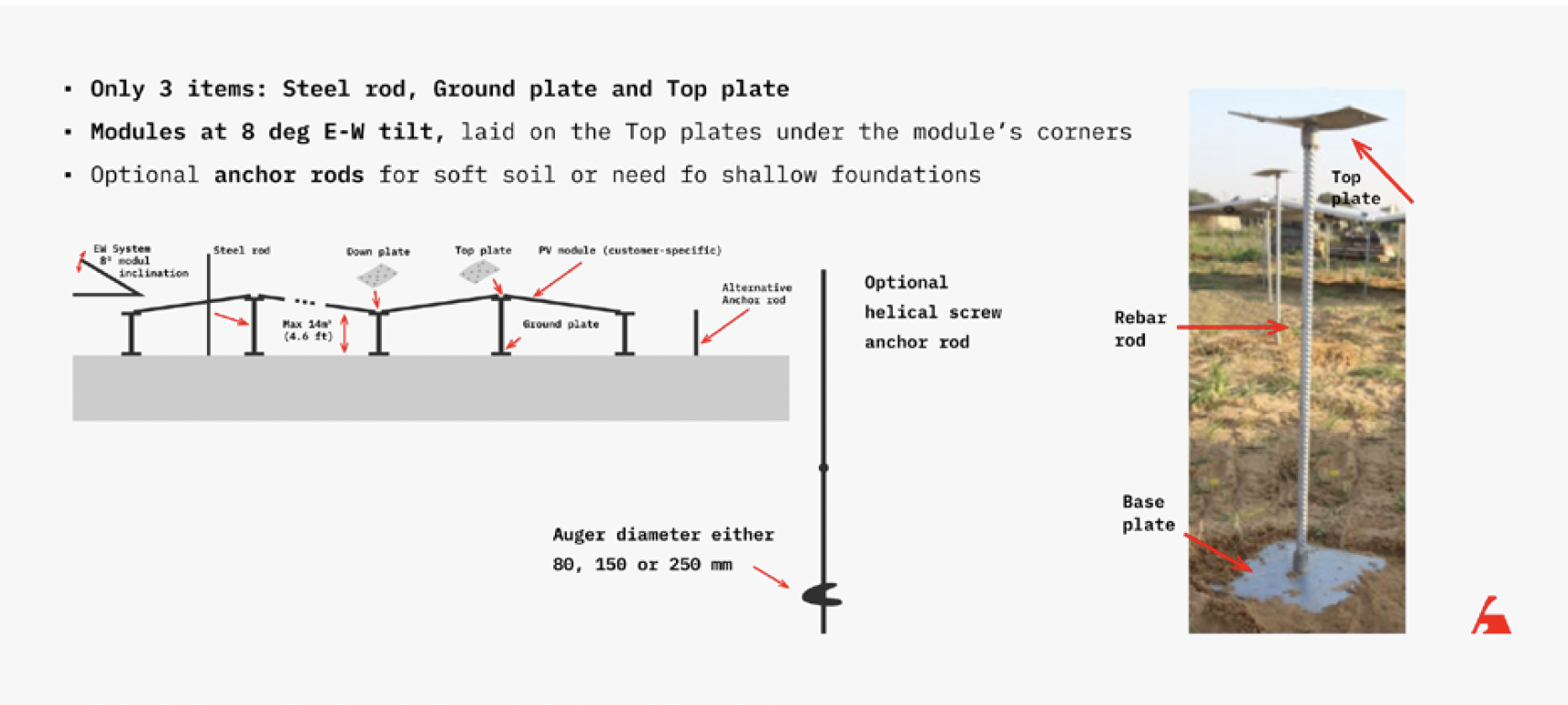

Solar farms typically use equipment like single-axis trackers that move to keep panels facing the sun (producing more electricity). Simpler layouts use fixed-tilt arrays that are stationary and angled for optimal sun exposure. Both designs must space rows of panels apart to prevent shading, and both need strong supports that withstand wind loads. Single-axis trackers add even more complexity with motors and other moving parts. The advantage of these systems is that they maximize the production of each panel. But as panels become cheaper, the extra cost of single-axis tracking or fixed-tilt is no longer advantageous. New solar farm designs lay the panels flat next to each other, much closer to the ground. Flat panels close to the ground need significantly less steel because they eliminate moving parts, limit wire run lengths, face reduced wind loads, are easier to maintain, and reduce land use by more than half. These panels produce less electricity, but the cost savings from simpler installation more than compensates. Jurchen Technology and Erthos are two companies building such systems.

FIGURE 01 | Jurchen Technology PEG System

Jurchen Technology PEG System

“Firming” solar output with batteries is the primary strategy to increase the utilization of grid connections. The solar farm can sell electricity near the capacity of the grid connection for more hours and shift electricity sales from midday to higher-priced morning and evening hours. Battery cell prices have fallen nearly as fast as solar panel prices; as with panels, cells are now a small portion of total installation cost. Lower prices have stimulated the grid storage market to the point where manufacturers can justify designs tailored for the application instead of repurposing car batteries. Modern batteries boast cheaper chemistries like lithium iron phosphate (LFP), larger cell sizes, improved cycle life, and tighter packaging. In 10 years it might be unusual to see solar farms without storage batteries.

Local Permitting Challenges

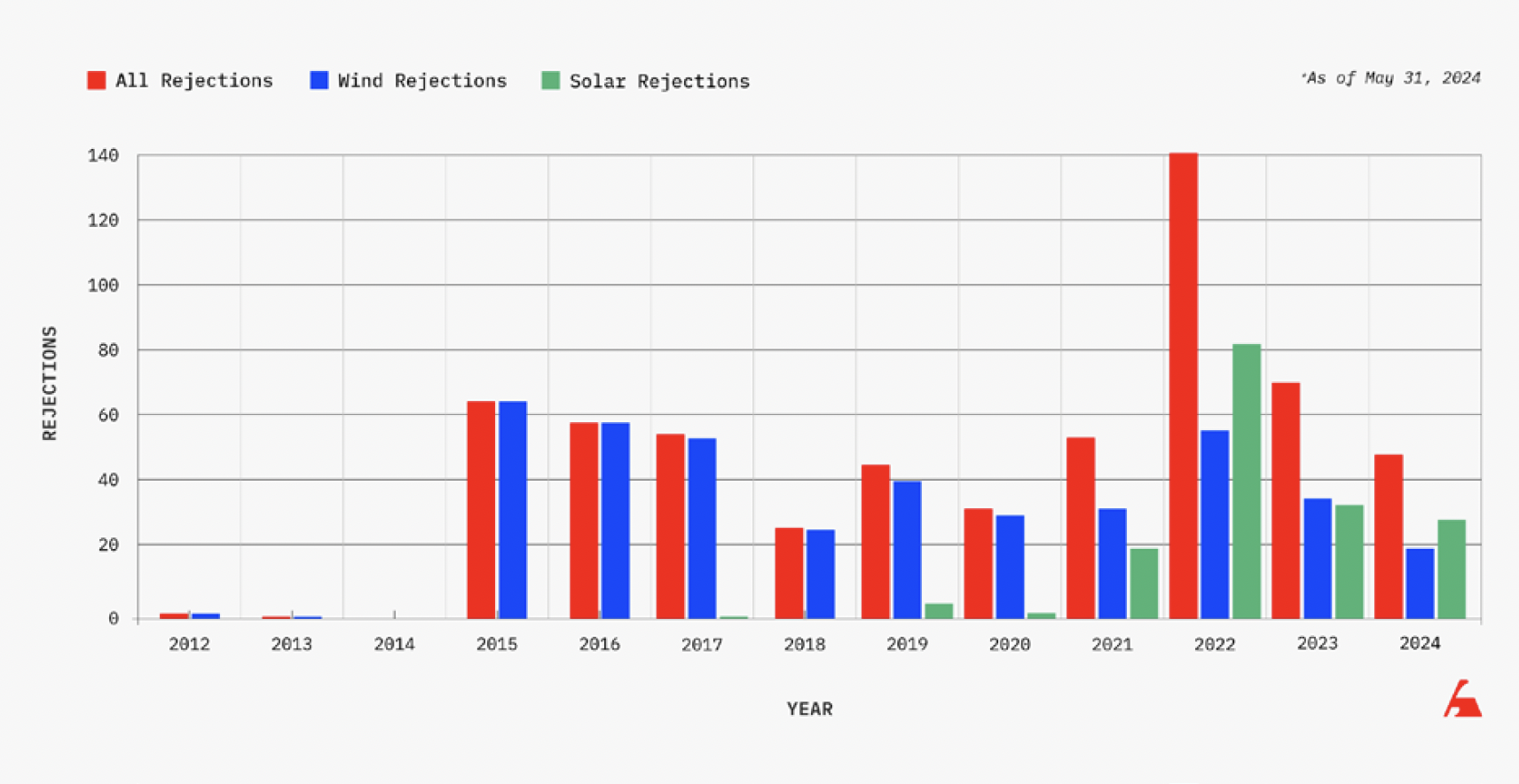

Solar developers rarely have trouble finding landowners willing to host a solar farm given the generous rental payments, but neighbors sometimes oppose new projects. They lobby local zoning boards or county commissioners to block solar projects. Planners have rejected 150 solar farm applications in the last six years.4 Rejections are minimal compared to the nearly 6,000 utility-scale projects in the United States that are in planning or already in operation, but the recent rise in rejections is concerning.5 Even more alarming are county-level bans. Wind turbines are more affected by these bans, but a dozen or so counties recently passed restrictions in Ohio and Virginia.Federal regulation impacts some solar farms, but most are on private land regulated by counties.

FIGURE 02 | Local Permitting Rejections

The most straightforward way to reduce such bans would be for states to limit local government’s ability to deny projects, which Michigan has done.6

Another option is to improve the value proposition for local residents. Because they have very few employees, solar farms’ main contribution to a community is through tax revenue. Opponents may appreciate that revenue, but they commonly complain about visibility and land use. Here is where compact solar farms become appealing. Compact solar farm designs with more efficient panels might use one-third of the land of traditional layouts, with panels less than one meter off the ground. This means that tax revenue will stay roughly the same, with significantly less impact on land use and visibility.

Batteries are also helpful because they take up a fraction of the space of solar panels. A 100 MW DC compact solar farm might use 150 acres, but batteries sufficient to sustain that output for four hours would only use a few acres. The property tax bill increases significantly with limited impact.

A confounding factor is that many states give solar and wind farms tax breaks, reducing the incentive for local governments to approve projects. Both Ohio and Virginia have such laws, though Ohio’s will expire at the end of 2024.7 The trade-off seems poor, especially when federal subsidies under the Inflation Reduction Act are so generous. The market will still try to clear—one solar developer in Virginia came to an agreement with a county to pay more than the standard tax would have been to secure an approval.8 Payments like these might seem suboptimal, but there should be competition between counties that keeps them reasonable.

Most solar farms are still able to obtain local approvals, and technology should further improve the value proposition. States have sticks and carrots available through their ability to limit local permitting authority and eliminate tax breaks.

Interconnection and Transmission

Interconnection is the process of getting a permit to sell electricity into the grid. Developers must submit an interconnection application to the grid operator that manages the transmission system and electricity market. The grid operator completes studies for each new application to identify the equipment (like transformers) required to connect to the grid and to determine whether the local feeder lines have enough capacity. They also look at potential impacts on voltage or frequency in the transmission system and other interactions with existing generators. These studies are often time-consuming since small changes can impact the transmission system for hundreds of miles.

Grid operators have a massive backlog due to increasing solar,wind, and battery storage project applications. The average solar or wind facility is smaller than traditional thermal power plants, and the low cost of these sources is encouraging historically large volumes.

There are three primary grid operator scenarios:

- a vertically integrated utility with monopoly rights;

- a regional transmission organization (RTO), regulated by the Federal Energy Regulatory Commission (FERC); and

- Texas.

Monopoly Utilities

The interconnection process is internal for these utilities. The public interface happens when they submit long-term plans to state regulators for approval. Cheaper solar and batteries make it harder for the utilities to leave solar out of their plans because opponents can submit alternative models to regulators that show the utility is not choosing the lowest cost plan. The “Beyond Coal” campaign was extremely successful with this strategy when utilities wanted to build new coal power plants 10 to 20 years ago.

Regional Transmission Organizations

RTOs are the focus of most policy chatter because developers have inundated them with applications. The developers don’t know which locations will have favorable interconnection costs, so they submit many applications and only go forward where the costs are low. Most RTOs are raising application requirements and trying to give developers budgetary estimates earlier to prevent spamming. They are also moving to cohorts that prevent engineers from getting stuck in a modeling loop where a new application arrives that changes the models. These cohort clusters also make it easier for projects to share upgrade costs.9

The process will hopefully speed up somewhat, but progress is slow and varies by RTO.

Texas

The Texas grid operator, ERCOT, takes a different approach called “connect and manage.” They make interconnection easier by not studying if a new facility will be able to deliver power 100 percent of the time, but they reserve the right to curtail a power plant to protect the transmission system.10 Developers can get approval easily but don’t know how much curtailment their project might suffer.

The difference between ERCOT and other RTOs is deeper than it seems because FERC-regulated RTOs believe they need to control the total amount of generation available. They do this through capacity payments (dampening wholesale price signals at various locations). If you believe that generation availability needs to be under central control, then you also believe that the transmission system must be able to handle those generators running at once. No generator can come online without extensive studies to make sure it won’t interfere with the plan. ERCOT/ Texas has an “energy-only” market that pays generators for the energy they produce. Prices and competition between power plant owners determine how much generation the system has. Connect-and-manage is a natural extension of this because generators will want to add capacity where supply is tight and transmission is constrained (high prices!).

Another important feature in Texas is that new transmission lines are competitively bid once the state regulator sees enough price imbalances to justify new lines or if the state wants to be proactive, like they were with the Competitive Renewable Energy Zones policy.11

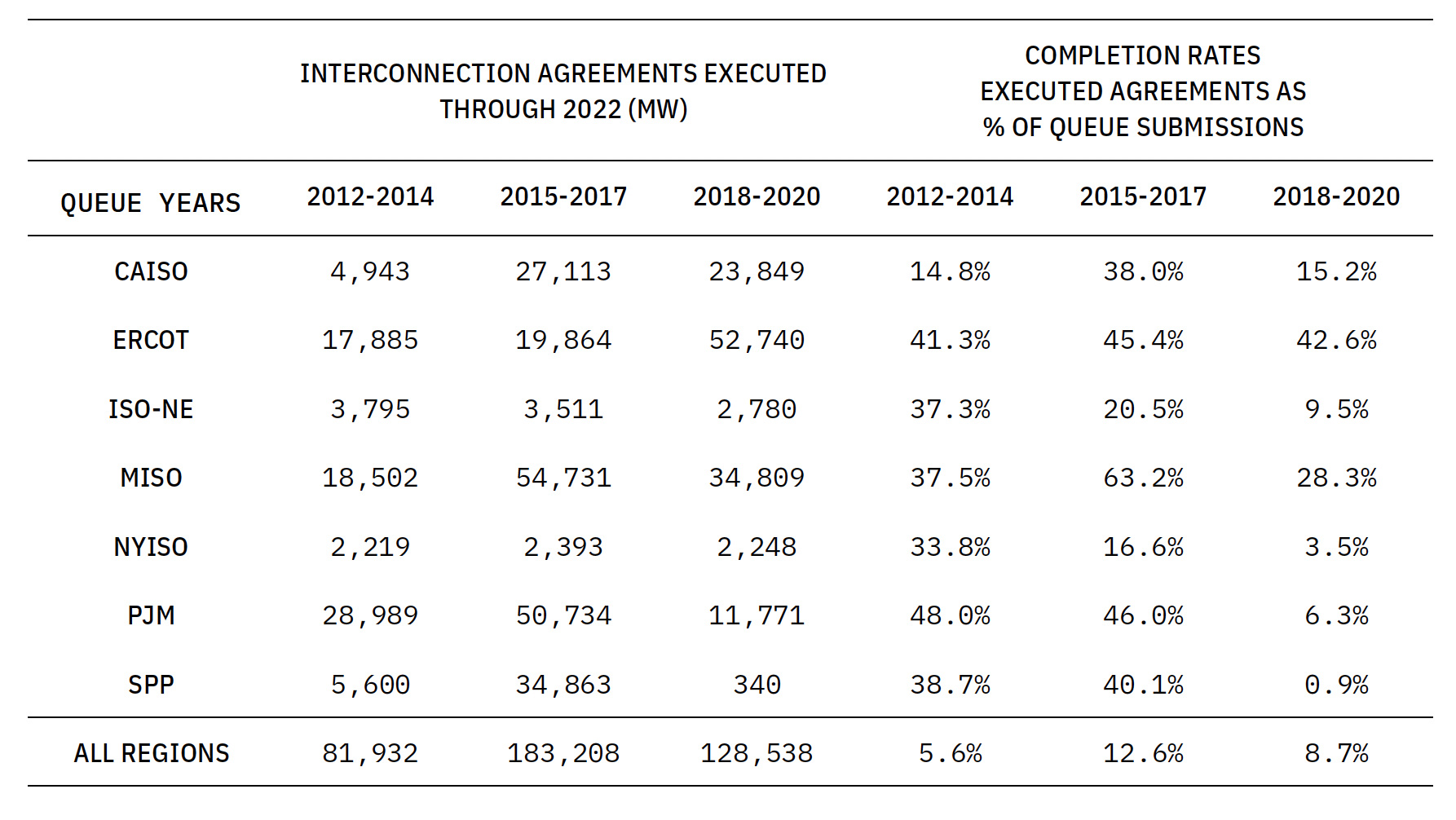

The result of these policies is that Texas has been able to add new generation capacity at a faster rate with better project survival rates than FERC-regulated RTOs.12

TABLE 01 | Interconnection Agreements Executed Through 2022 and Completion Rates

Driving Improvement

The Texas/ERCOT approach maximizes transmission utilization while the traditional RTO methods do the opposite and maximize generator deliverability at the expense of transmission utilization. Maximizing transmission line utilization better fits a world where developers are lining up to build power plants and batteries. It seems likely that the RTOs will improve some through incremental reforms but will not reach the efficiency of the Texas model. In a recent paper, electricity market researcher Jacob Mays makes the case for the switch to “connect and manage” and proposes a financial model to fund new transmission and avoid central planning by state utility commissions.13 To make this change, FERC-regulated RTOs would need to abandon controls like capacity markets, and states would have to overcome utilities’ opposition to competitive transmission.

Utility-Scale Solar’s Market Impacts

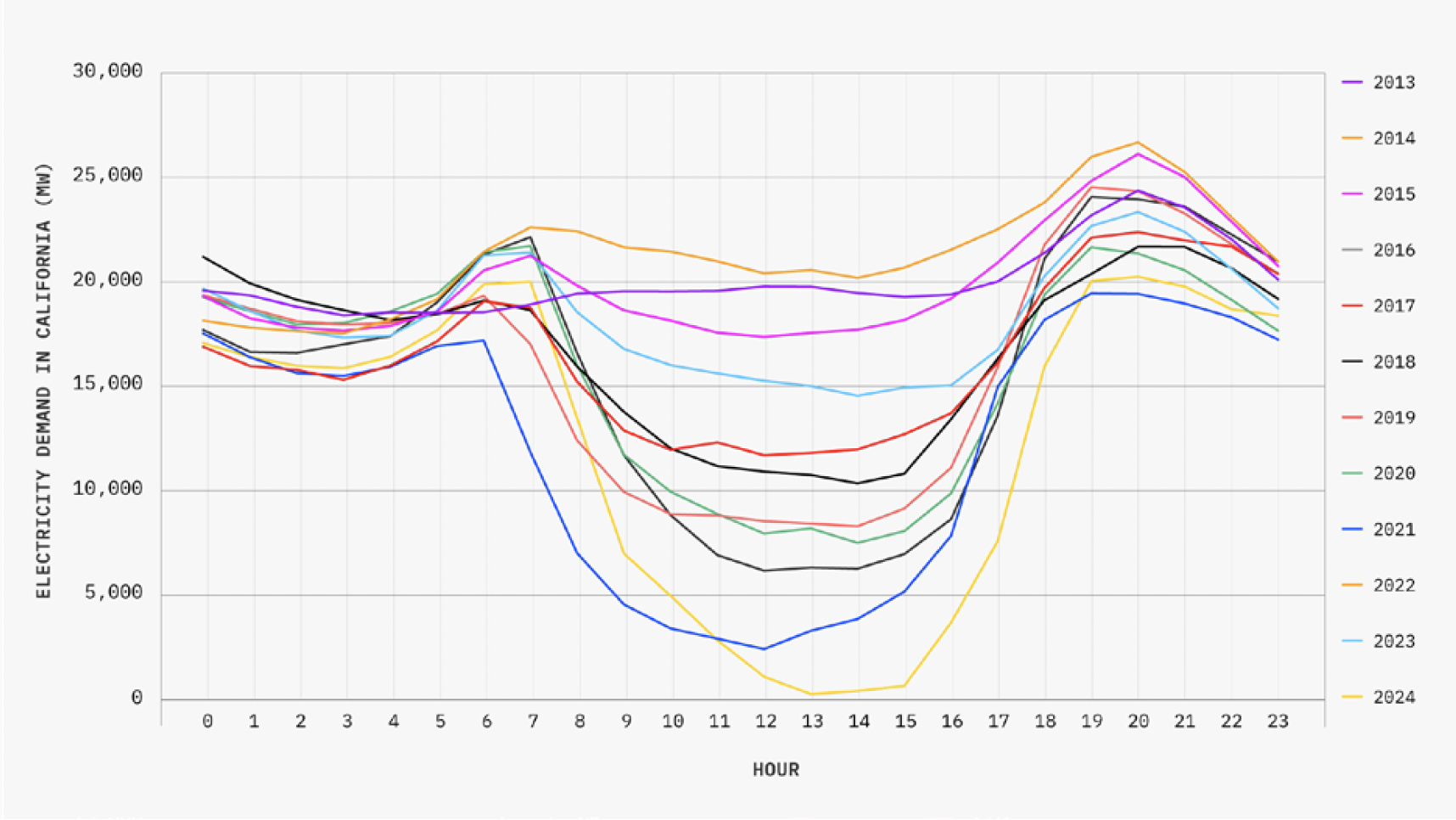

Solar farms’ correlated production can crash the midday electricity price. Electricity prices can go negative and grid operators might have to curtail solar to keep operating the thermal plants that are needed in the evening after the sun sets (many take too long to restart). Many refer to this problem as the “duck curve” because non-solar generation goes to zero during the day but has to ramp quickly in the evening, forming a duck neck.

FIGURE 03 | California’s Duck Curve is Getting Deeper

Batteries solve this problem by allowing solar farms to sell electricity at steadier rates for more hours of the day and at higher prices. They will make the grid operator’s job easier as they enter service. Similar to interconnection, the policy advice is to simplify markets so that batteries can be added quickly and aren’t subject to Byzantine rules originally designed to accommodate less flexible thermal power plants.

Import Tariffs

The United States currently has anti-dumping tariffs on solar panels imported from China. It also has restrictions on panels that contain polysilicon produced in Uyghur provinces. These policies add uncertainty on top of the tariffs because there has been an ongoing investigation into solar panels imported from Southeast Asia that may contain too many Chinese components. These account for a large portion of US supply, and importers can suffer punitive penalties after the fact if they are deemed noncompliant. As a result, US solar panel prices are two to three times the global average in early 2024.

These tariffs are a tax on intermediate goods and energy, increasing the cost of new solar in the United States. The desire to stimulate US production is politically popular, and the current Inflation Reduction Act subsidies for manufacturers can exceed global prices. If a manufacturer earning double the price can’t survive, then they probably should not be in business. Ending the tariffs would be a boon to the US solar industry.

Distributed Solar

Distributed solar is more expensive than utility-scale, but it avoids the cost of electricity distribution, which is now a larger share of the cost than wholesale power prices.14 The price differential between distributed and utility-scale solar varies dramatically based on the regulatory environment, local labor costs, and market scale.

The focus below is on residential installations. Commercial and community solar projects have many of the same issues but are less affected because of their larger size.

The flash points are regulatory impacts on installation cost,customer acquisition cost, subsidies/subsidy design, and how distributed solar interacts with the grid. These issues are intermingled and reinforce each other.

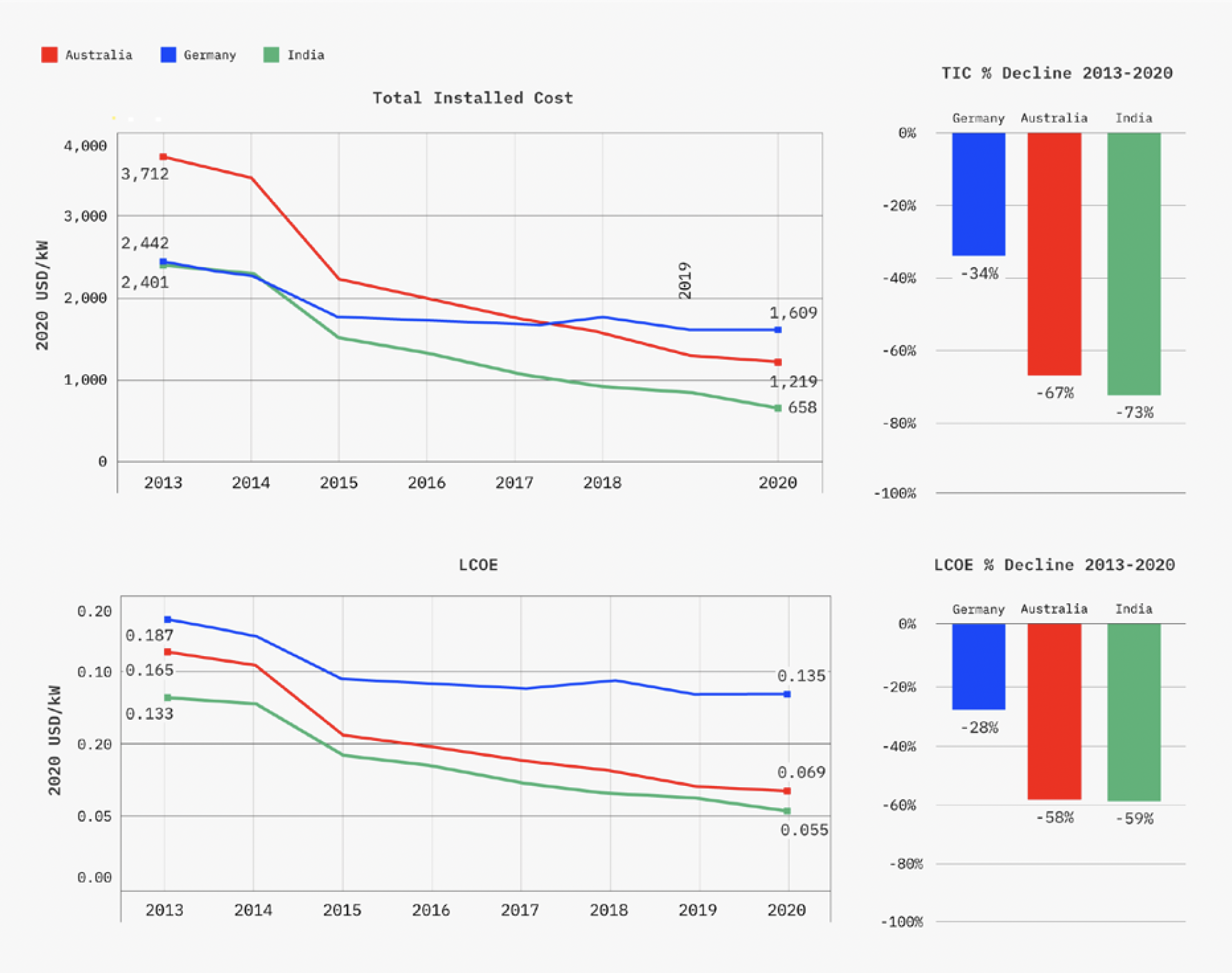

Comparing Distributed Solar in the United States and Australia

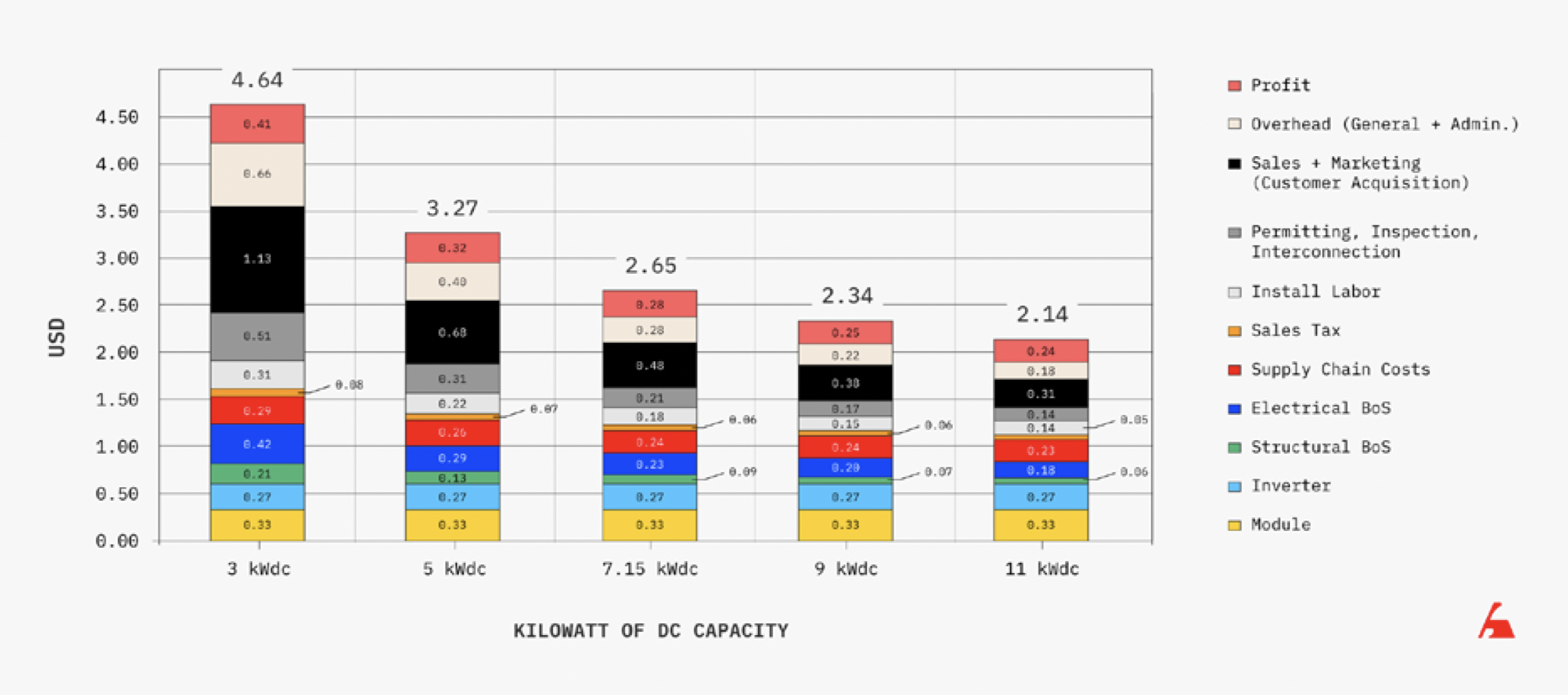

Distributed solar in the United States is incredibly expensive compared to places such as Australia and Germany. An unsubsidized 3 kW system in the United States costs $4.64/watt vs. $1.20–$1.50/ watt in Australia. These cost differences have persisted for over a decade, and the Rocky Mountain Institute (RMI) investigated the causes in 2014.15 It found the differences mainly come from “soft costs” such as installation labor, customer acquisition cost, permitting, and so on. In fact, the customer acquisition and overhead costs for a 3 kW system in the United States are more than the total cost of a 3 kW system in Australia.

FIGURE 04 | Q1 2021 US Residential Benchmark, by PV System Size (2020 USD/WDC)

FIGURE 05 | Falling Solar Installation Costs

Some cost centers have seen significant improvements in the last 10 years, namely installation labor. RMI found the US installers were several times slower at the same tasks. Installation labor cost per watt has more than halved in estimates from the National Renewable Energy Laboratories (NREL), likely driven by worker experience, more efficient solar panels, and equipment designs that are easier to install.

Customer acquisition costs and permitting have stayed the same or become more expensive. That is logical if installers are taking advantage of lower equipment and installation labor costs to sell to less-excited customers in less-forgiving jurisdictions.

RMI explored the customer journeys, which explain much of the cost difference. In Australia, customers usually learn about solar through word of mouth and get quotes on comparison websites. There is enough business that most installers choose to compete heavily on pricing to drive volume. Permits, inspections, and interconnection are very simple, inexpensive, and fast, with uniform standards across the country. Customers often pay in cash given the low cost, and the installer handles all rebates and subsidies, passing the savings on to the customer.16

Americans are more likely to learn about solar from a door-to-door salesperson because low solar penetration limits word-of-mouth marketing. Higher solar prices and lower electricity costs in most of the country make it less exciting for regular consumers. Financing is a barrier in the sales process, and American customers are more likely than their Australian counterparts to drop out during this phase. Permitting times and codes vary based on jurisdiction and can take months with many redesigns. Both the utility and the local jurisdiction must inspect and approve the system before it turns on, which can take months.

Australia has created a virtuous cycle where high electricity prices and falling solar hardware costs generated enthusiasm for distributed solar systems. Installers were able to commoditize their offerings and processes because of the customer interest, low paperwork burden, and national uniformity in regulation. Robust competition pushes prices lower and further forces commoditization.

The United States could create a similar feedback loop, especially in sunny states with high electricity prices. It becomes easier every year as technology and costs continue to improve. The important job for policymakers becomes facilitating a regulatory structure that encourages stiff competition and commoditization of distributed solar.

The Impact of Future Technologies on Distributed Solar

Technology can help break the logjam by reducing installation complexity, helping reduce the permitting burden, and creating entirely new pathways into homes that avoid many of these blockages.

Reducing installation complexity is incredibly important. Simpler systems have fewer surfaces for permitting and interconnection to snag on. Lower cost and more predictable installations make selling solar systems much easier and reduce the need for complex financing products. Storage products incorporated into the system can eliminate the need for exports where interconnection is challenged.

There are also products such as plug-in solar panels or appliances with integrated batteries that can be purchased through typical e-commerce channels and installed with DIY labor. They can put competitive pressure on the industry and provide options for customers that desire smaller systems (which are the most impacted by soft costs).

Some of the most promising ideas are continued simplification of solar equipment, better permitting software, more plug-in solar, and solar-ready appliances.

- Continued Simplification of Solar EquipmentTraditional solar systems might have monitoring, controls, shutoff switches, inverters, battery management systems, and batteries that must be installed and wired in separately. Companies are merging these components in one package to simplify installation. The recently announced Tesla Powerwall 3 is just one example where the product contains almost all of the intermediate components. One worker can install it in a few hours, and the only connections are to the panel and the solar array. A system like this not only reduces field labor but also reduces the chances for mistakes or varying interpretations that cause inspection failures and interconnection issues.

- Better Permitting SoftCountries like Australia have an advantage with national building codes and uniform permitting, allowing installers to compete easily across wider areas. The United States will never be that way given its structure that delegates building codes to cities and counties. However, software like the Department of Energy’s SolarAPP+ can enable instant permitting and is a backdoor to unifying codes across jurisdictions. There are also companies selling AI software that offer similar instant permitting benefits.

- More Plug-In SolarPlug-in Solar is a recent phenomenon in German homes and apartments. Several German companies sell systems that customers set on their balconies and plug into a wall outlet. It is entirely DIY and costs as little as $0.50/watt.17 Many installations aren’t registered or permit-dependent. The electricity flows through the wall plug’s circuit to the panel to feed the rest of the home. These surged in popularity during the 2022 European energy crisis. Germany passed favorable rules to increase the maximum size and provide protection to tenants.18 Some systems even include batteries to allow more solar production. These products have gone global and are available on marketplaces like Amazon.

- Solar-Ready AppliancesElectrification of appliances is a growing trend. Many retrofits run into the “electrician problem.” The home or business’s existing wiring can’t handle the new load, or electrical work would eat the savings. Many appliance makers are responding by making appliances that can run on regular 110V circuits. They can reduce power usage through efficiency (heat pump water heaters) or add integrated batteries to handle peak power (induction stoves). Any reduction in power usage makes going solar or using plug-in solar easier. The other appeal of these systems is that customers can easily buy them online or at big box stores with cash and avoid any red tape. A household might incrementally add more appliances with integrated batteries and plug-in solar as they can afford it, leading to a similar result as a small system with a battery for a fraction of the price and hassle.

Policy to Increase Competition and Improve the Customer Journey

Australia and other leading markets show that the key to reducing soft costs is a simple process paired with a short payback time for customers, driving scale. The market and new technology can drive down hardware, installation, and some overhead costs. Categories such as permitting and interconnection require policy intervention and will only grow as a share of costs. Customer acquisition costs are downstream of these other factors and will decrease as prices fall and markets mature.

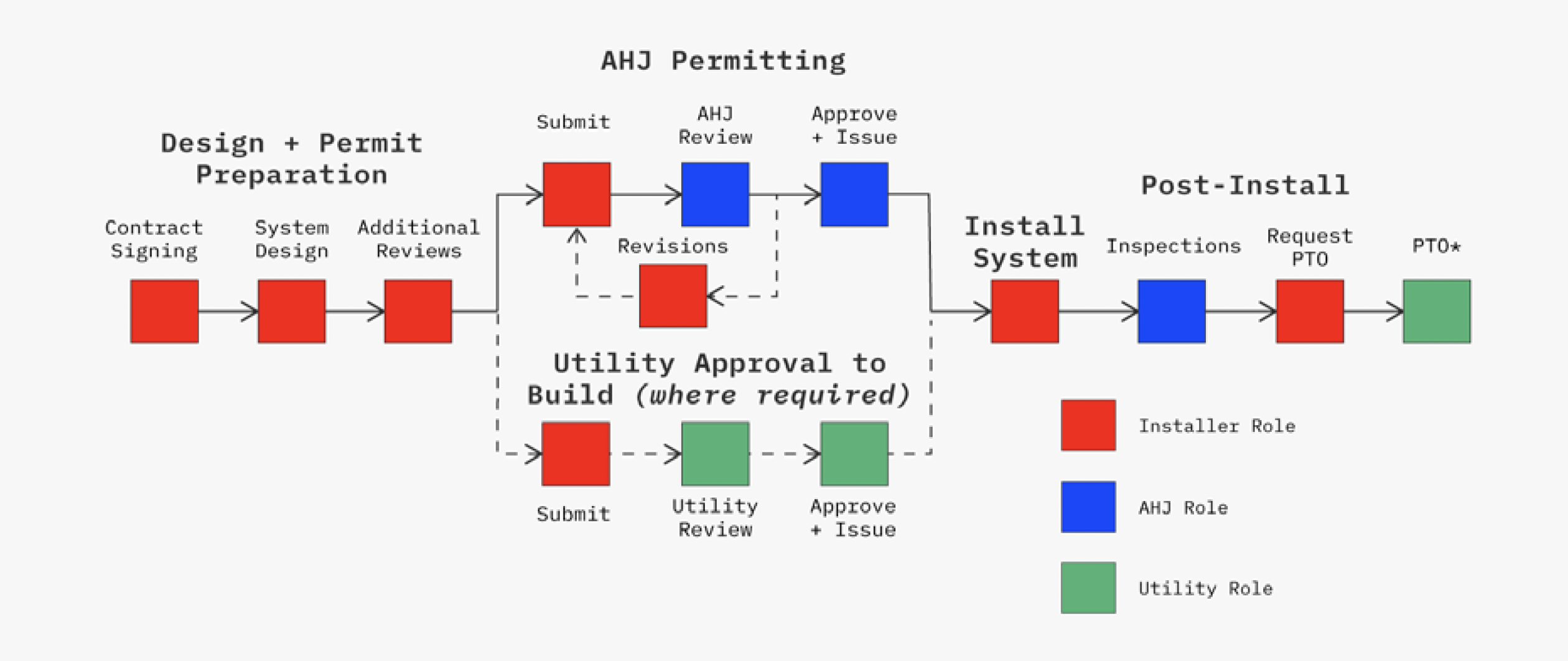

Tackling Permitting and Inspection

Permitting, inspection, and interconnection account for $0.14– $0.51/watt in the United States, depending on system size. There can also be significant delays and rework from failed inspections that raise costs and increase overhead. The impact is much heavier on small systems, discouraging them and robbing installers of scale. Even worse, many installers report that they do not bid projects in jurisdictions with difficult permitting, or they charge 10 to 20 percent more for a project.19 The NREL cost data are empirical, so the permitting impact is likely higher in any random zip code because completed installations will be biased toward those with smoother permitting processes. Improving these processes would decrease direct cost, reduce delays, reduce rework, and boost competition between installers that allows for lower prices and more scale.

FIGURE 06 | The Rooftop PV Permitting Process

Ideally, there would be clear standards. A salesperson could accurately tell customers what to expect. An installer would submit a standardized application for automatic approval (if a permit is required at all). The installation crew could finish in one day without returns for inspections or rework, and the system would be ready to turn on immediately.

The Department of Energy is trying to improve the system via its SolarAPP+ program. SolarAPP+ automates permitting review and approval. Solar installers have a clear and consistent platform to use across localities. The project launched in 2021, and 160 permitting authorities adopted it by the end of 2023. Several hundred more are in the early stages of adoption.

The most common issue holding up adoption is software compatibility. The next most significant is that SolarAPP+ uses standard building codes. Some cities and counties have made their own modifications, so those entities will have to change their codes to use the software.

The program works once adopted. Approval time falls to one day, and the typical SolarAPP+ project reaches completion 14 days faster than the average non-SolarAPP+ project. It has already saved local governments 33,000 hours of installation labor—a cost which would have been passed on to customers.20

There are now grants to encourage adoption, and policymakers should push local governments to use the system. California recently passed a law that forces most counties and cities to adopt the process. The system could be as efficient as a simple registration at the limit while creating a pseudo-national solar code, helping the industry scale and dramatically reducing the burden on smaller solar arrays.

Simplifying Interconnection

Most solar installations in the United States send electricity back to the grid when solar production exceeds household use; this is known as net metering. Compensation for this excess electricity can be generous or zero, depending on the state and utility. Utilities usually require approval for new systems hooked up this way and vary in their friendliness, increasing the permitting burden.

Utility justification for gatekeeping primarily comes from the need to prevent clusters of solar systems from increasing voltage or disrupting frequency on local distribution circuits. They also want to ensure that disconnects are properly installed to protect lineman during outages.

Until recently, it was impractical to do anything but export. That is changing with cheaper batteries, smart thermostats that can “pre-cool” homes midday, smart hot water heaters, and the adoption of electric cars with smart charging. States with high distributed solar adoption (e.g., California and Hawaii) encourage reducing exports through programs such as NEM 3.0 and HECO’s “self-supply” tier.

If customers are not exporting, then much of the rationale for utility interconnection agreements goes away. The city or county inspector can approve energization after ensuring the system will not feed back into the grid. Hawaii Electric Co. briefly had a policy like this called “Quick Connect” to shorten the COVID backlog. It allowed customers to turn their systems on before utility inspection, shortening utility approval times.21 Policymakers at the state level would be wise to create programs like this as a default. Customers that want to export or participate in other programs could use their systems in self-supply mode while they wait for approval.

Legalizing Plug-In Solar

At some point people will start plugging in solar panels whether the authorities allow it or not (see Germany). Having set standards for equipment would allow many to access this inexpensive technology in a more organized manner.

Subsidy and Rate Design

The two primary ways to subsidize distributed solar are through a lump sum payment near the time of installation and a subsidized price for every kilowatt-hour produced.

The United States uses tax credits. The historical norm is a credit for up to 30 percent of the installation cost. Providing the subsidy as a tax credit as a portion of the installed cost has many undesirable side effects. It disincentivizes a reduction in purchase price compared to flat payments per unit of capacity because the subsidy increases when installation costs are higher. The customer must also front the money and only months later sees benefit from the credit.

The customer journey is much worse in the United States because it requires looking up and understanding tax returns. Many don’t have enough tax liability to use the full credit and can only access it indirectly through “leases” where the installer owns the panels and the customer pays a monthly fee. Sales reps now have to talk to homeowners about their taxes, navigate complex offerings like leases, and answer a million “what-ifs” about what happens if the homeowners need to sell their house, and so on. A simple transaction turns into a complex contract requiring significant relationship building.

A more ideal subsidy would be a capacity-based rebate similar to Australia’s—one which installers can collect and convey to customers through discounts. Policymakers could adjust the subsidy level to meet a certain installation goal or to limit the cost of the program to a set amount.

Subsidies based on kilowatt-hours produced is another successful strategy; Germany’s feed-in-tariff is the most famous example. “Net metering” can also be a version of a feed-in tariff.

How well these policies stimulate distributed solar demand is purely a function of the export price level versus the installation cost. States with high retail electricity prices, such as Hawaii and California, saw rapid growth in residential solar after passing net metering laws. Solar owners historically get paid high retail rates even if wholesale market prices crash in the middle of the day. They often oversize their solar system to earn more money. Governments usually revoke or adjust the policy as it becomes expensive.

Utilities typically dislike net metering because of the competition and the need to account for numerous small generators. Some utilities try to charge fixed fees for solar customers because customers might have $0 power bills even as they consume electricity during expensive hours and export when prices are low.

Policy tends to move toward encouraging battery storage, lowering payments per kilowatt-hour for exports, or limiting exports to the grid. Hawaii is a great example where net metering led to a boom that flooded the grid and local circuits during the day, forcing the end of the program. Several reboots compensated exports at lower rates or based on market conditions, but those filled rapidly. California’s NEM 3.0 is a similar story, and exports inAustralia now only earn around one-third of the retail price.22

Utilities and state regulators have a solution if they feel. distributed solar is unfair. Big commercial and industrial users already pay separately for fuel and infrastructure on their bills through “demand” charges. It would be simple to compensate distributed solar exporters at the fuel cost or hourly wholesale price and charge them for infrastructure based on their peak usage in the billing period. Customers should also have the option to join a bundling organization and earn money from providing grid services, like exporting more during times of grid stress.

Both types of subsidies can work, so the primary concern is reducing the side effects. It is important to keep lump sum payments simple for the customer, and net metering needs to account for the value of the service rather than a simple measure of kilowatt-hours.

Summary

It is an exciting time in the solar industry because of rapidly decreasing prices, growing adoption, and improving technology. Policymakers can institute several changes to keep riding the wave.

For utility-scale solar:

- Limit Local Authority to Deny SolarRestrict local governments’ ability to deny solar projects while eliminating property tax breaks that reduce their revenue. These tax breaks are counterproductive because they reduce local governments’ willingness to approve solar farms.

- Simplify Grid Interconnection with Connect and ManageImplement market-based, simplified interconnection processes to reduce fees and uncertainty, enabling faster generator integration and better transmission utilization.

- Adopt New, Cost-Effective TechnologiesEncourage monopoly utilities through state regulatory hearings to adopt newer, cheaper technologies.

- Market-Driven Solar and Batteries will Smooth Production and ConsumptionAllow market forces to develop more affordable solar farm designs and integrate storage batteries to enhance value. Solar’s variability is being tamed by falling battery costs, and policymakers need only to let it happen.

- End Solar Panel TariffsRemove tariffs on solar panel imports. Tariffs on solar panel imports add uncertainty and cost. Policy should focus instead on supply-side industrial policies to boost domestic production if necessary.

For distributed solar:

- Adopt SolarAPP+ to Simplify PermittingPromote the adoption of simplified permitting processes, such as SolarAPP+, to reduce costs and expand competition for solar installers.

- Eliminate Utility Approval for Safe Home SystemsRemove the need for utility approval for home systems with safe designs, bypassing the interconnection process for non-exporting systems.

- Legalize DIY SolarFormalize and legalize plug-in and DIY solar systems, following examples set by countries like Germany.

- User-Friendly Investment Tax CreditConvert the investment tax credit into a lump sum payment claimable by installers so that savings pass directly to customers.

- Refine Net Energy MeteringAdjust net energy metering rates to accurately reflect the market value (or lack thereof) of electricity exported to the grid.

These changes would allow the solar industry to grow in a healthier way that benefits a larger share of the population.

1 Mark Bolinger et al., “Utility-Scale Solar, 2022 Edition” (Lawrence Berkeley National Laboratory, 2022), https://emp.lbl.gov/publications/utility-scale-solar-2022-edition.

2 Mark Bolinger et al., “Utility-Scale Solar, 2022 Edition” (Lawrence Berkeley National Laboratory, 2022), https://emp.lbl.gov/publications/utility-scale-solar-2022- edition.

3 “TOPCon Solar Cells: The New PV Module Technology in the Solar Industry,” SolarMagazine, March 2023, https://solarmagazine.com/solar-panels/topcon-solar-cells/.

4 Robert Bryce, Renewable Rejection Database, accessed May 31, 2024, https://robertbryce.com/renewable-rejection-database/.

5 5 “Major Solar Projects List,” April 2024, https://www.seia.org/research-resources/major-solar-projects-list.

6 Garret Ellison and Ben Oren, “Michigan House Votes to Restrict Local Authority overWind, Solar Farms,” November 2023, https://www.mlive.com/public-interest/2023/11/michigan-house-votes-to-restrict-local-authority-over-wind-solar-farms.html.

7 7 “Assessment of Solar Facilities,” Virginia State Corporation Commission, accessedJune 20, 2024, https://www.scc.virginia.gov/pages/Assessment-of-Solar-Facilities.

8 Mickey Powell, “Solar Farm Developers Would Pay $3M+ in Benefits in Lieu of Taxes,”The Winchester Star, February 23, 2024, https://www.winchesterstar.com/winchester_star/solar-farm-developers-would-pay-3m-in-benefits-in-lieu-of-taxes/article_be39b865-ad08-5ae9-817d-a612de351016.html.

9 Claire Wayner et al., “Going the Distance on Interconnection Queue Reform”(Rocky Mountain Institute, August 3, 2023), https://rmi.org/going-the-distance-oninterconnection-queue-reform/.

10 William Driscoll, “Faster, Lower-Cost Interconnection by Combining ERCOT, MISO,PJM Approaches – Pv Magazine USA,” PV Magazine, June 29, 2022, https://pv-magazineusa.com/2022/06/29/faster-lower-cost-interconnection-by-combining-ercot-miso-pjmapproaches/.

11 “Transmission and CREZ Fact-Sheet” (Powering Texas, 2018), https://www.poweruptexas.org/wp-content/uploads/2018/12/Transmission-and-CREZ-Fact-Sheet.pdf.

12 John D Wilson et al., “Generator Interconnection Scorecard: RankingInterconnection Outcomes and Processes of the Seven U.S. Regional Transmission SystemOperators” (Advanced Energy United, February 2024), https://advancedenergyunited.org/hubfs/2024%20Advanced%20Energy%20United%20Generator%20Interconnection%20Scorecard%20(1).pdf.

13 Jacob Mays, “Generator Interconnection, Network Expansion, and Energy Transition,”IEEE Transactions on Energy Markets, Policy and Regulation 1, no. 4 (December 2023):410–19, https://doi.org/10.1109/TEMPR.2023.3274227.

14 Duncan Campbell, “Cheaper Energy, Pricier Wires,” April 2, 2022, https://www.duncancampbell.com/p/cheaper-energy-pricier-wires.

15 Koben Calhoun et al., “Reducing Solar PV Costs Through Installation LaborEfficiency” (Rocky Mountain Institute, 2014), https://rmi.org/wp-content/uploads/2017/04/2014-11_RMI-AustraliaSIMPLEBoSFinal.pdf.

16 “Government Rebates and Loans for Solar | Energy.Gov.Au,” Australian Government,accessed June 20, 2024, https://www.energy.gov.au/solar/financial-benefits-solar/government-rebates-and-loans-solar.

17 Gero Rueter, “Mini Plug-in Solar Panels: Are They Worth It?,” DW, November 9,2023, https://www.dw.com/en/mini-plug-in-solar-panels-are-they-worth-it/a-66240262.

18 Carolina Kyllmann, “German Econ Ministry to Simplify Installation of Plug-in Solar‘Balcony Power Plants,’” Clean Energy Wire, May 24, 2023, https://www.cleanenergywire.org/news/german-econ-ministry-simplify-installation-plug-solar-balcony-power-plants.

19 Jeffrey J. Cook et al., “Exploring the Link between Project Delays and CancelationRates in the U.S. Rooftop Solar Industry,” Energy Policy 156 (September 2021): 112421,https://www.sciencedirect.com/science/article/abs/pii/S0301421521002913.

20 “160 Communities Now Automating Solar Permitting with SolarAPP+,” Office of EnergyEfficiency & Renewable Energy, December 20, 2023, https://www.energy.gov/eere/solar/articles/160-communities-now-automating-solar-permitting-solarapp.

21 “Hawaiian Electric Speeds up Rooftop Solar Interconnections,” 2021, https://www.hawaiianelectric.com/hawaiian-electric-speeds-up-rooftop-solar-interconnections.

22 “How Solar Net Metering Works in Australia: Everything You Need to Know,” SolarFlow, December 13, 2022, https://www.solarflow.com.au/how-solar-net-metering-works-inaustralia-everything-you-need-to-know.